Elon Musk, the CEO of Tesla, extended an invitation to billionaire investor Warren Buffett on Monday. Musk suggested that Buffet should consider investing in Tesla, which is going through a rough patch due to the global slowdown in electric vehicle (EV) sales.

An X user suggested Buffett’s Berkshire Hathaway should sell its shares in Apple and instead invest in Tesla. Musk concurred, stating it would be an obvious move for Buffett to consider.

Despite Berkshire Hathaway holding a stake in Chinese EV maker BYD, it has not invested in Tesla.

However, this isn’t the first time Musk has advocated for Buffett’s involvement in the company. He previously invited Buffett to invest in Tesla when the company was valued at a mere 0.1% of its current worth, which is now over $700 billion. Musk expressed regret that Buffett didn’t seize the opportunity to invest early on.

Tesla’s Financial Struggles

The American EV maker is going through significant financial challenges. The company recently reported substantial losses in the January-March quarter, with net profits plummeting by 55% to $1.13 billion compared to $2.51 billion in the same period last year.

Moreover, Tesla slashed prices in key markets like China, Europe, and the US, signalling a global pricing adjustment. According to Musk, fluctuating prices are necessary to match the company’s production with market demand.

In China, The Model 3 comes with a price tag of 231,900 yuan (₹26.6 lakh). Also, the Model Y faced a price cut, falling to 249,900 yuan (₹28.7 lakh) from 263,900 yuan.

In the United States, the base Model Y starts at $42,990. Further, the EV giant slashed prices by $2,000 for the premium Model Y variants.

Also, the American EV giant decided to cut its global workforce by more than 10%.

Wrapping Up

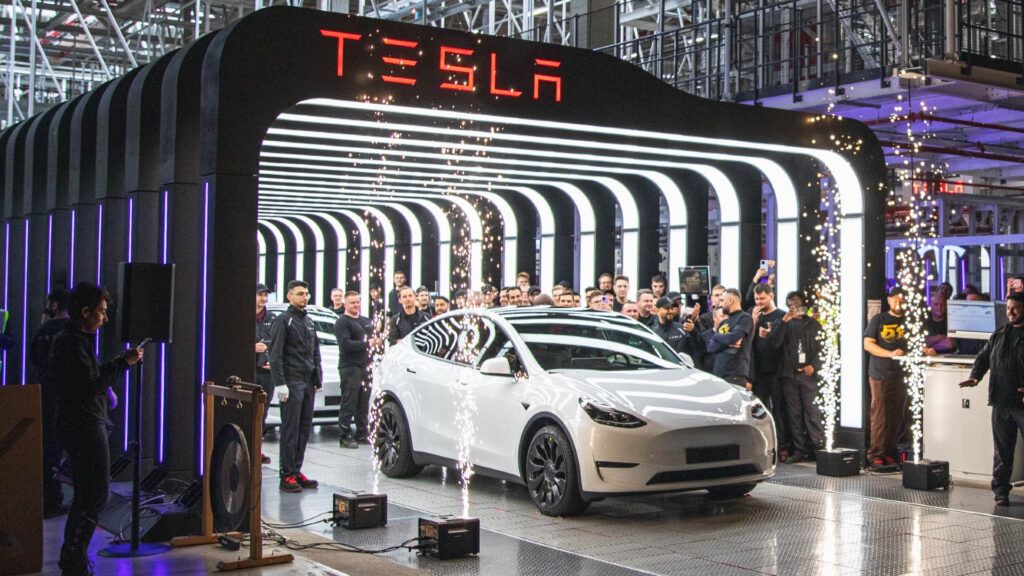

In response to these difficulties, Musk has been focused on reorganizing company’s operations. Despite setbacks, Tesla remains a dominant force in the EV market, with continued innovations in technology and manufacturing.

As the automotive industry undergoes a transformative shift towards electrification, Tesla’s future remains closely watched by investors and enthusiasts alike. The potential involvement of Warren Buffett could signal a significant development in the company’s trajectory amidst its current trials and ambitions for growth.