Those keeping an eye on the lithium industry had hoped the metal used in batteries would recover after a big drop. But now the prices have fallen again this month. There are more supplies of lithium building up because there isn’t much demand for electric vehicles right now. Well! This is not a good sign for the industry.

Notably, the prices of lithium carbonate in China have dropped to the lowest level since August 2021. According to Bloomberg, the most active futures on the Guangzhou exchange have decreased by 12% this month.

Prices have fallen because they dropped more than 80% in 2023, mainly because of too much supply and slow demand growth. Even though prices stopped falling earlier this year, too many products are still waiting to be sold. However, customers are not buying anything yet.

Susan Zou, an analyst at Rystad Energy, says that increasing lithium production and slower summer demand are causing prices to decrease. Also, manufacturers facing slower growth in demand for electric vehicles are reducing their orders for lithium products. They believe they might be able to buy more inventory later at even cheaper prices.

Automaker Decisions Impact Lithium Stocks

The stock prices of companies that produce lithium have also been facing difficulties. Investor confidence in stocks and mining companies that supply raw materials for automakers like Ford Motor, General Motors, and Tesla has worsened as these automakers have scaled back their plans for EVs in recent months.

Albemarle’s stock has fallen by 23% in June, bringing its total loss for the year up to 34% as of Friday’s closing price. Lithium Americas Corp., which is a potential supplier for General Motors, has dropped by 55% this year. Moreover, the shares it offered in April were sold at a significant discount. Piedmont Lithium Inc., which has a supply agreement with Tesla, has seen its stock price decline by 64% in 2024.

Despite this, some major companies have been active in making deals in the past few months. In May, Equinor ASA announced its plan to purchase a 45% stake in two lithium project companies in Arkansas and Texas from Standard Lithium Ltd.

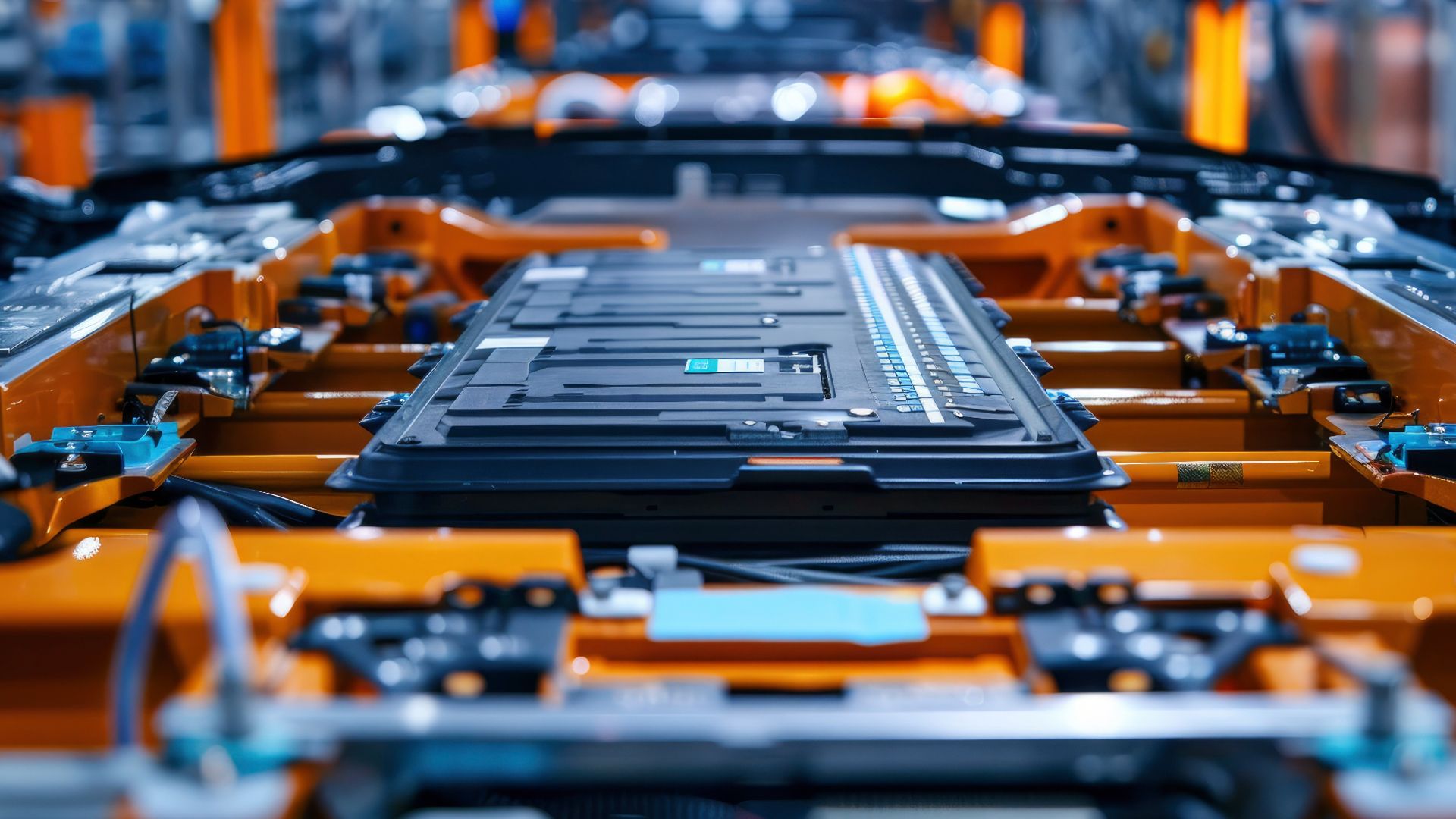

Impact on the EV Market

BloombergNEF reduced its estimates for BEVs sales by 6.7 million vehicles in its annual Electric Vehicle Outlook until 2026. Also, it still predicts that lithium demand from batteries will increase to nearly 3.5 million tons by 2035. Now, this is almost three times the level expected for 2024.

“We are experiencing the effects of the rapid growth in electric vehicles,” said Quentin Lamarche from Techmet-Mercuria. He referred to the global transition to EVs.